Active Treasury Management: Adding Miles to Your Runway

For most businesses, liquidity is both a safety net and a growth lever. Whether you are a startup with fresh capital, a mid-market company balancing growth with stability, or an enterprise managing surpluses, how you deploy treasury funds can define your financial resilience.

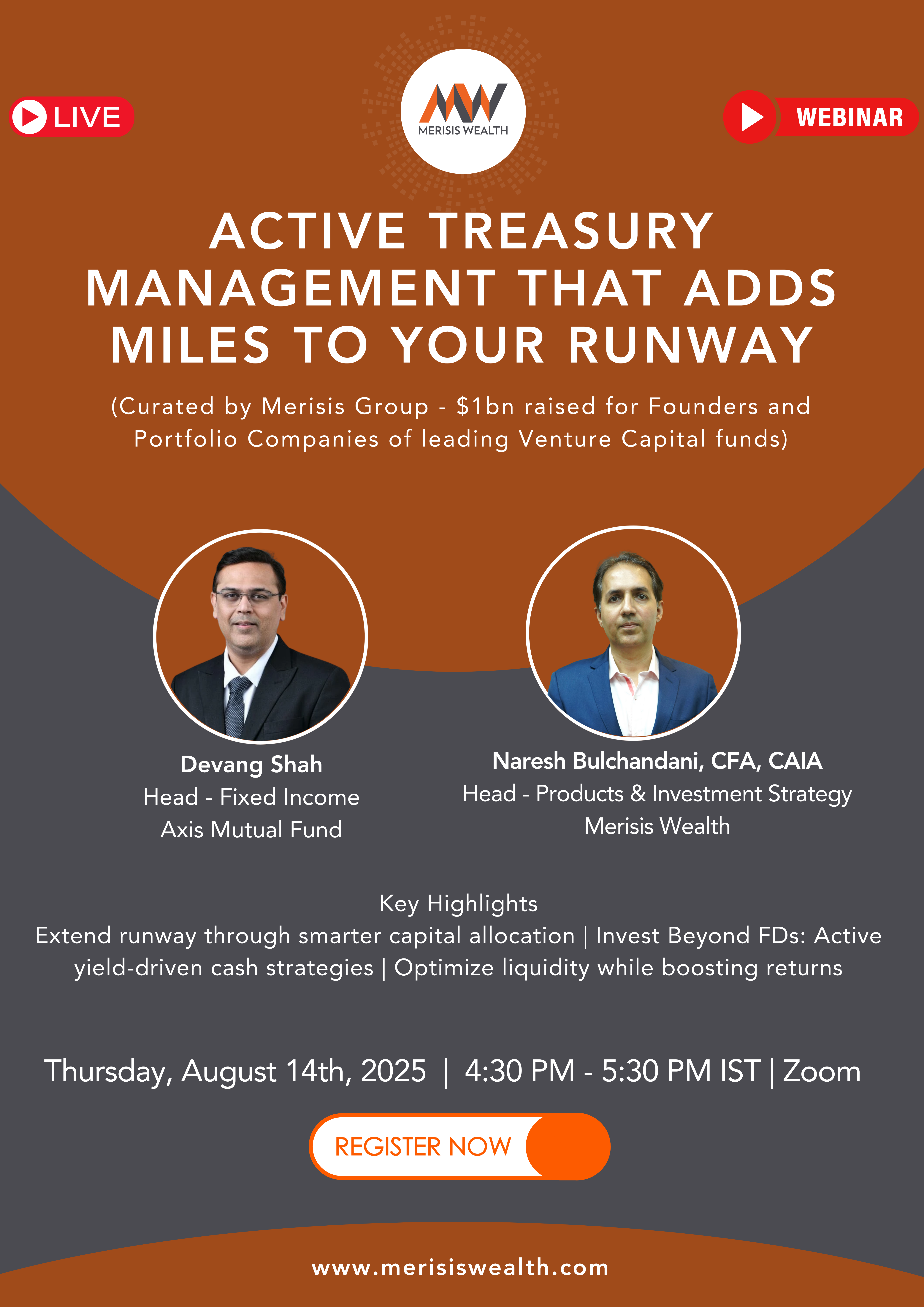

In a recent webinar — “Active Treasury Management: Adding Miles to Your Runway” — investment experts discussed why business treasuries must move beyond passive parking of funds and adopt active, yield-driven strategies. By managing liquidity smarter, companies can not only preserve capital but also extend their operational runway in a meaningful way.

Why Passive Treasury Management Falls Short

The traditional approach to treasury management has been safety-first — surplus funds are typically parked in fixed deposits, liquid funds, or short-term bonds. While this guarantees stability, it leaves a lot on the table:

-

Low real returns: Inflation eats into idle cash, reducing actual purchasing power.

-

Opportunity cost: Businesses forgo higher-yield opportunities that could add to the bottom line.

-

Mismatched liquidity: Surpluses are often locked in structures that don’t align with cash flow needs.

-

Lack of optimization: With multiple options now available, failing to rebalance means capital works sub-optimally.

In a climate where runway is critical — especially for founders and CFOs in fast-growing companies — passive treasury management is no longer enough.

What Active Treasury Management Looks Like

The webinar highlighted how businesses can actively manage treasury by focusing on three pillars:

-

Liquidity Segmentation

Break treasury into tranches: operating liquidity (immediate needs), strategic reserves (6–12 months), and long-term surplus (growth capital). Each tranche can then be deployed into instruments that balance liquidity and yield. -

Yield Enhancement Strategies

Move beyond vanilla FDs and explore instruments such as high-quality credit funds, structured debt, market-linked debentures, and short-duration alternatives. These can deliver returns well above passive placements — without unduly compromising safety. -

Continuous Monitoring & Governance

Active doesn’t mean risky. It means reassessing allocations regularly, rebalancing as markets shift, and building strong governance frameworks so capital is secure yet productive.

Key Takeaways for Businesses

-

Runway extension is a financial strategy, not just a funding one: Smart treasury deployment buys time in uncertain markets.

-

Risk-adjusted returns matter: The focus should be on instruments that balance yield with safety, not chasing high returns blindly.

-

Expert oversight pays dividends: Professional management and monitoring can help businesses avoid concentration risks and liquidity mismatches.

Who Benefits Most?

This approach is particularly relevant for:

-

Startups and scale-ups with freshly raised capital looking to stretch cash burn

-

Corporates with operational surpluses seeking optimized deployment

-

Family businesses and promoters who want better returns on parked capital

-

CFOs and treasury professionals responsible for balancing safety and efficiency

Final Word

Active treasury management is about making your capital work harder — not recklessly, but intelligently. In today’s environment, businesses that take a strategic approach to liquidity and yield can strengthen their resilience and extend their financial runway meaningfully.

📺 You can watch the full webinar here: Watch Now

📩 If you’re an HNI, promoter, or business leader looking to explore the best treasury management strategies for your needs, feel free to reach out for a deeper conversation. Book a meeting here on www.calendly.com/merisiswealth

.png?width=352&name=Pms%20Webinar%20by%20Merisis%20Wealth%20(11).png)