The Family Financial Calendar: A Sacred Tool for Intergenerational Wealth Planning

Akshaya Trithiya to Children’s Day — Financial Conversations That Secure Your Legacy

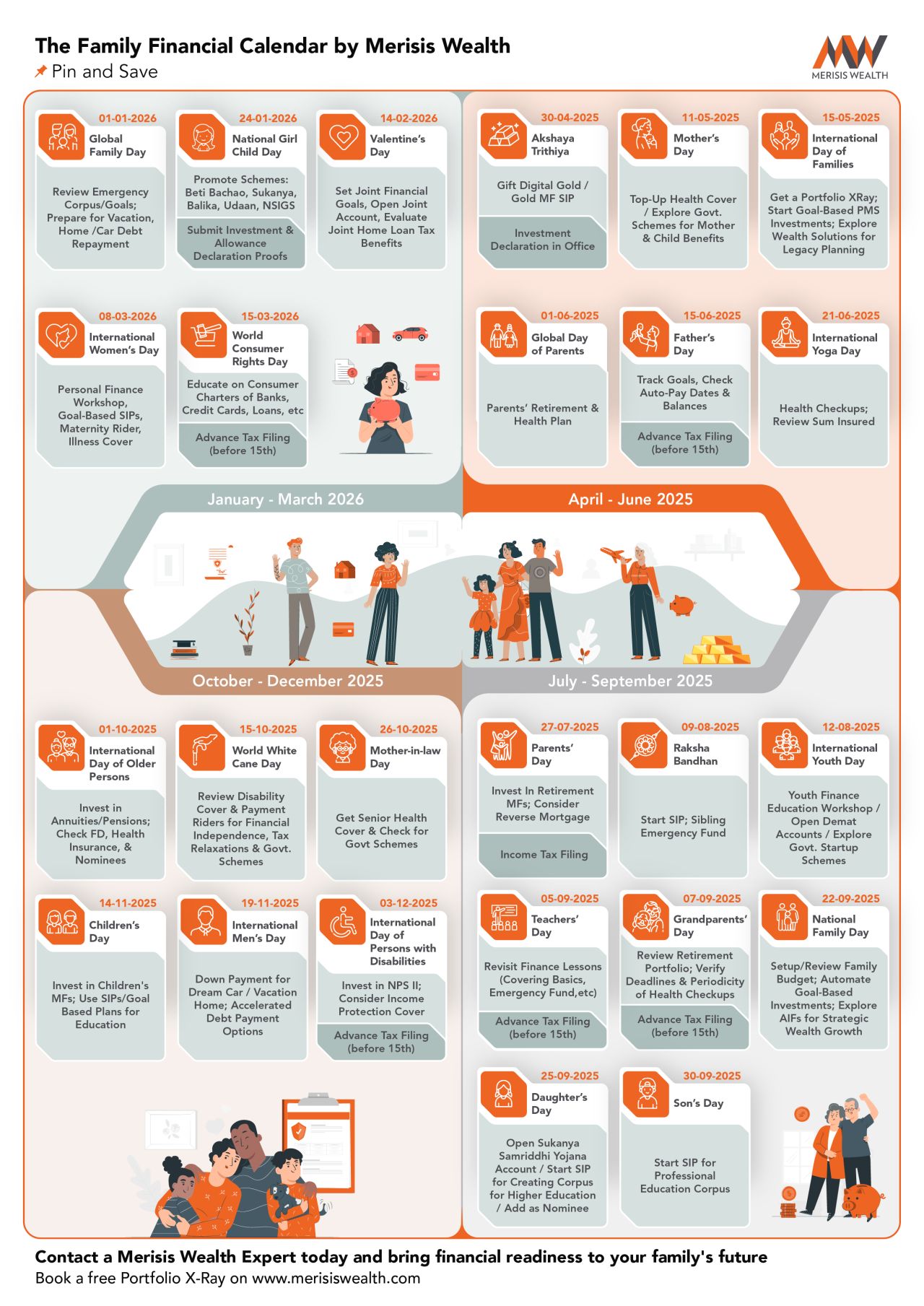

What if every family had a calendar that didn't just mark time, but built wealth? This is the question we asked ourselves at Merisis Wealth — and it led us to create the Family Financial Calendar, a thoughtfully curated guide that aligns key life moments and relationships with strategic financial decisions.

Starting on Akshaya Trithiya, a day symbolizing prosperity and lasting value, and stretching across the financial year till March, this calendar acts as a month-by-month wealth roadmap for families serious about building and preserving a legacy.

In an age of rising life costs, unpredictable markets, and fragmented generational communication about money, such a calendar is no longer a luxury. It is sacrosanct.

💡 Why Every Household Needs a Family Financial Calendar

In Indian households, financial conversations are often siloed, delayed, or avoided altogether. Parents rarely talk to children about money. Children seldom know where the documents are. Spouses may not always be aware of nominees, insurance terms, or legacy planning structures.

The result? Confusion, delays, missed opportunities — and sometimes, irreversible financial mistakes.

At Merisis Wealth, we work closely with families across generations. We've seen the gaps firsthand. That’s why this calendar isn't just about wealth creation — it’s about wealth continuity.

🪙 Why We Begin with Akshaya Trithiya

Akshaya Trithiya, falling on April 30 this year, is traditionally celebrated by buying gold — a symbol of purity, permanence, and prosperity.

But in today’s financial world, prosperity needs diversification. That’s why we recommend:

-

Starting a Digital Gold SIP or investing in Gold Mutual Funds

-

Reviewing your overall portfolio for balance and risk

-

Using this auspicious beginning to get a Portfolio XRay — a detailed look into your current investments, gaps, and opportunities

-

Beginning Goal-Based PMS strategies to align long-term aspirations with asset performance

This is the first date in the calendar — because if there’s any day that deserves to be the financial new year, it’s Akshaya Trithiya.

🧭 A Year-Round Wealth Compass: Month-by-Month Highlights

Here are a few key moments from the Family Financial Calendar:

May – June: Prioritizing Parents & Planning Ahead

-

Mother’s Day (May 11): Time to top up her health cover and have that long-pending conversation about online scam protection.

-

International Day of Families (May 15): Schedule a Portfolio XRay and explore wealth solutions for intergenerational planning — including estate planning and private PMS strategies.

-

Global Day of Parents (June 1): Plan their retirement, review pensions, and prepare for rising medical expenses.

July – September: Building Discipline & Legacy

-

Raksha Bandhan (Aug 9): Start an SIP or emergency fund for your sibling — small habits, big security.

-

Youth Day (Aug 12): Open a Demat account for your children or nieces/nephews. Introduce them to PPF or mutual funds.

-

National Family Day (Sep 22): This is your budget review checkpoint. Rebalance assets and explore Alternative Investment Funds (AIFs) as part of your growth strategy.

October – December: Protecting the Vulnerable

-

Elderly Day (Oct 1): Invest in annuities, check senior citizen FD rates, and update insurance.

-

Children’s Day (Nov 14): Begin SIPs for education. Teach your children about compounding.

-

Disability Day (Dec 3): Secure dependents’ futures through NPS-II, disability cover, and income protection plans.

January – March: Reset, Reflect, Realign

-

Global Family Day (Jan 1): Start the year with a wealth review — emergency corpus, insurance riders, asset rebalancing.

-

Women’s Day (Mar 8): Talk to the women in your life about financial independence. Help them start SIPs, understand tax planning, and explore maternity-specific insurance.

-

Consumer Rights Day (Mar 15): Discuss cybersecurity, nominee updates, and estate documents.

🗝️ The Unspoken Elephant in the Room: Wills, Nominees, and Conversations About Death

One of the most important — and most avoided — conversations in Indian households is about what happens after we’re gone.

Wills, nominations, power of attorney, succession — these are not just legal matters. They are acts of love and responsibility.

This calendar is your way to normalize those conversations. Use key days like Grandparents’ Day, Elderly Day, or even Family Day to gently open the dialogue. Tie financial steps like estate planning, nominee checks, and portfolio reviews to these occasions.

At Merisis Wealth, we routinely help clients set up trusts, succession documents, and nominee updates as part of our advisory process. It's not awkward — it's essential.

👨👩👧👦 From Returns to Responsibility: Wealth Is a Family Business

Whether you’re a first-generation wealth creator or a steward of inherited assets, the reality is this: Your wealth affects your entire family.

This calendar helps you treat wealth as a shared responsibility, not a secret or burden. It turns cultural observances into financial milestones — where every Raksha Bandhan, Children’s Day, or Valentine's Day becomes an opportunity to reinforce financial security and shared goals.

💼 Why Choose Merisis Wealth?

Merisis Wealth is a premier wealth management firm offering a full-spectrum advisory service with a sharp edge in alternatives. From mutual funds and fixed income to PMS, AIFs, and private investments, we tailor wealth strategies that align with your family’s priorities, risk appetite, and long-term goals.

-

Portfolio XRay and diagnostics

-

Goal-based investment planning

-

Access to exclusive PMS & AIFs

-

Succession and estate planning assistance

-

Quarterly reviews and holistic advisory

We go beyond product selection — we architect long-term prosperity.

📌 Final Thoughts

The Family Financial Calendar by Merisis Wealth is more than a campaign — it’s a mindset shift. It’s about seeing wealth not just as a number, but as a narrative that involves your parents, children, spouse, and legacy. Print it. Share it. Use it. And most importantly — start talking about money at home.

✅ Ready to personalize this calendar to your family’s goals?

📞 Speak to a Merisis Wealth Advisor today. Book a Free Portfolio XRay.

🌐 Visit: www.merisiswealth.com

.png?width=352&name=Press%20(4).png)

.png?width=352&name=Press%20(6).png)